Sc Pension Worksheet

PEBA is the state agency responsible for the administration and management of the states retirement systems and employee insurance programs for South Carolinas public workforce. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

I Only Need Help With The Chegg Com

Step 2bMultiple Jobs Worksheet Keep for your records If you choose the option in Step 2b on Form W-4 complete this worksheet which calculates the total extra tax for all jobs on only ONE Form W-4.

Sc pension worksheet. The planning needs a record of the expenses to mention in the worksheet. 1106 State Optional Retirement Program ORP Active Incidental Death Benefit Beneficiary Form South Carolina Retirement System 1107 Employer Certification of Police Officers Retirement System PORS Eligibility. Department of the Treasury Internal Revenue Service.

The list of the various payments must be added to the worksheet. The other states return shows wages of 20000. Get thousands of teacher-crafted activities that sync up with the school year.

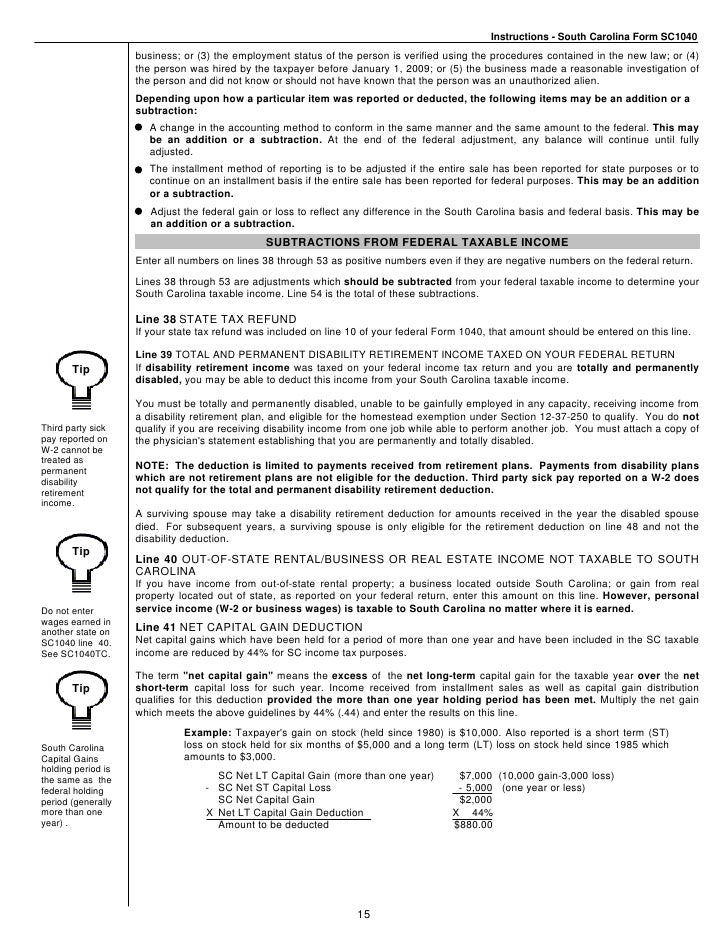

For South Carolina residents younger than 65 years old the state income tax will apply to any pensionretirement system distributions with a sizable 3000 deduction. 1103 BeneficiaryTrustee Designation Form All Systems 1104 Election of Non-Membership. Pension and IRA Worksheet.

Participates in the states Retiree Health Insurance Trust Fund. Instructions on line F of the worksheet. More than 600000 public employees are covered by the five defined benefit retirement plans and PEBA administers insurance benefits to more than 500000 members.

For this purpose total. New Jersey Pension and IRA Worksheet. Use the worksheet below to compute the state tax addback on the SC 1040.

Give SC state employees 401k. R is a resident of South Carolina who works in another state. Itemized deductions from 2019 federal 1040 Schedule A line 17.

Early retirement from the South Carolina Retirement System under the 5525 provision will delay your eligibility for funding. Schedules NJ-DOP and NJ-WWC. Keep the worksheets for your records.

How are my taxes affected by the coronavirus COVID-19 pandemic. If the charter school for which you work does not participate in a PEBA-administered retirement plan. Separate here and give Form W-4 to your employer.

Since the worksheet currently does not match the state form TurboTax is warning you to wait for that the worksheet before e-filing the state. Enter the federal standard deduction you would have been allowed if you had not itemized. The South Carolina income tax rate for tax year 2020 is progressive from a low of 0 to a high of 7 The state income tax table can be found inside the South Carolina 1040 instructions booklet.

No other income sources appear on the other states return. To find a financial advisor near you try our free. Employees Withholding Allowance Certificate.

Do not submit this worksheet with your return. Last year lawmakers pledged tax money to bail out the state pension system and promised to come back this year and reform it. The state has some of the lowest property taxes in the country.

Gains from Sale of Property Wounded Warrior Caregivers Credit. Enter zero if filing status is Married Filing Separate MFS. Keep it with your tax records.

Health Care Coverage. For more information see. Instructions - South Carolina Form SC1040 Worksheet for State Tax Addback 1.

South Carolina does not tax Social Security retirement benefits. On the worksheet you will be asked about your total income. It also provides a 15000 taxable income deduction for seniors receiving any other type of retirement income.

And that will decide at the expense of your to plan of. Out-of-state losses If you reported losses from out-of-state rental property a business located outside South Carolina or. Overview of South Carolina Retirement Tax Friendliness.

But seniors anyone 65 and older receive a massive 15000 deduction. So far theres been no rush to act. 2018 sc1040 individual income tax form and instructions south carolina department of revenue dorscgov january 2019 rev.

Ad The most comprehensive library of free printable worksheets digital games for kids. List the various payments. Get thousands of teacher-crafted activities that sync up with the school year.

Credit for Income or Wage Taxes Paid to Other Jurisdiction. Line 2 would be 20000 as that gross amount before deductions. Worksheets are for entering the expenditure on it.

The Pension worksheet will be updated as soon as possible to match this. Printable South Carolina state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020. New Jersey Property Tax Worksheet.

The income is from social security pension annuity etc. Ad The most comprehensive library of free printable worksheets digital games for kids.

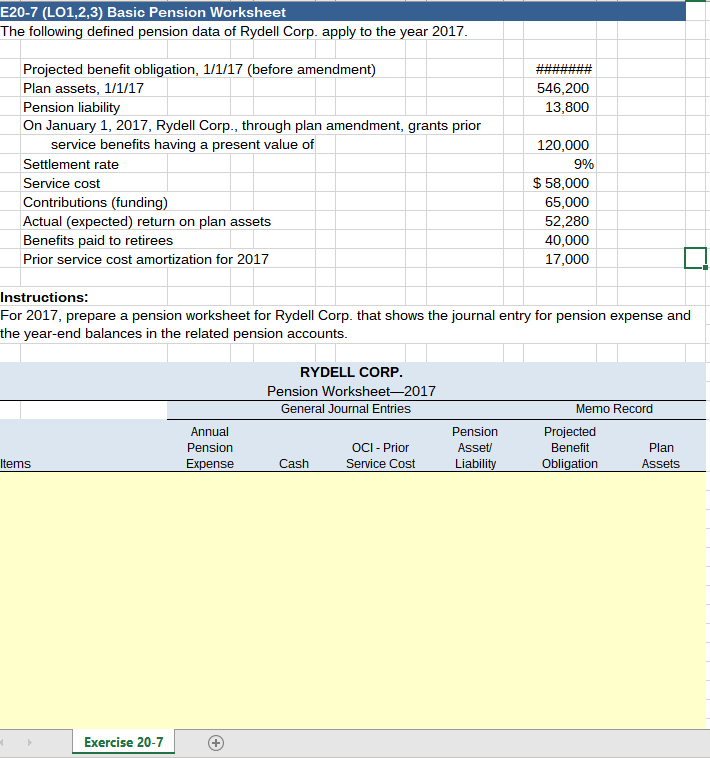

Form Isp 1003a Download Fillable Pdf Or Fill Online Estimate Request For Canada Pension Plan Retirement Pension And Post Retirement Benefit Canada Templateroller

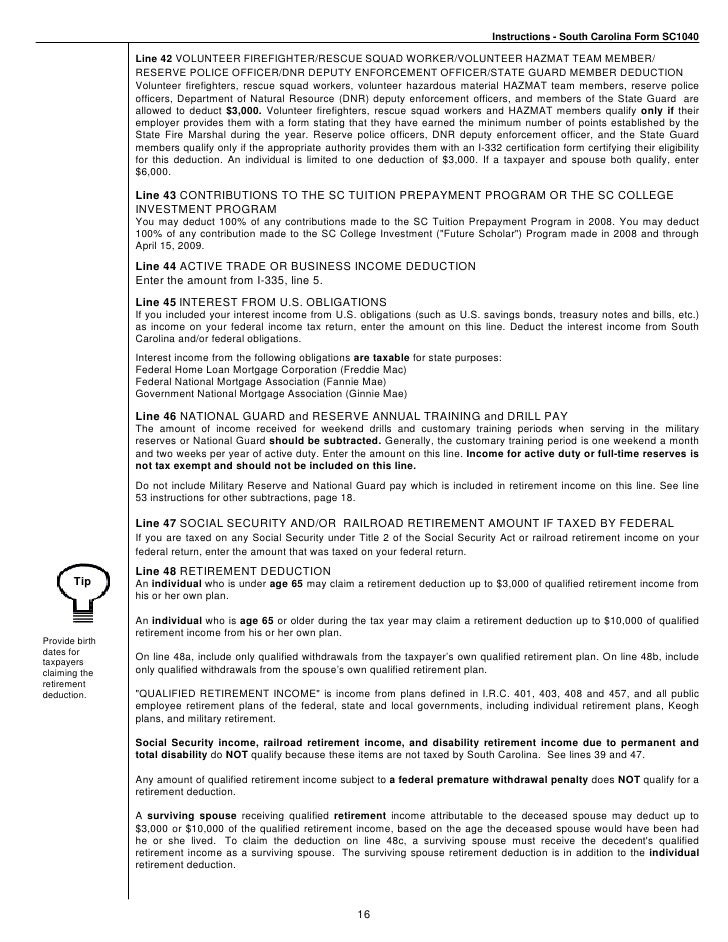

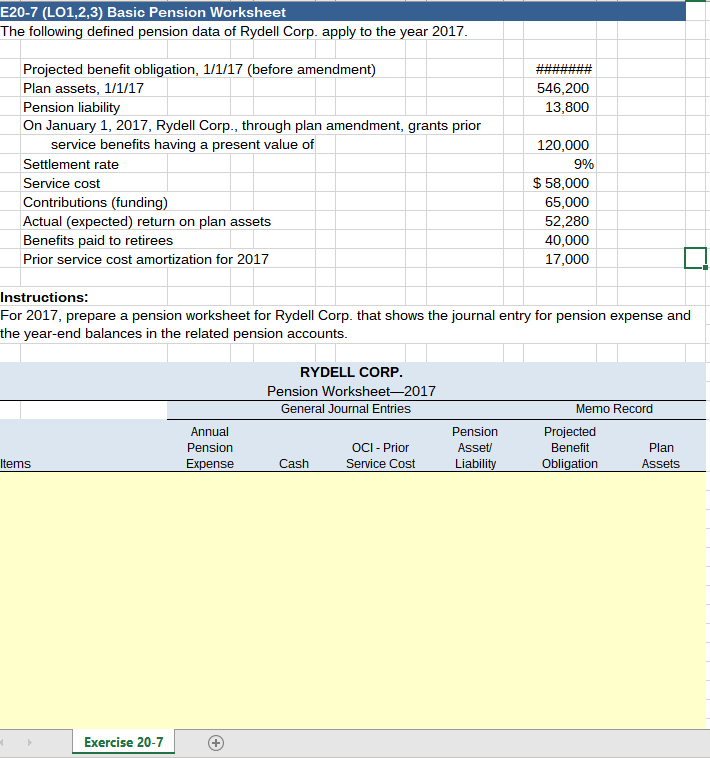

E20 7 L01 2 3 Basic Pension Worksheet The Following Chegg Com

Chapter 19 Pension And Other Post Employment Benefits Post Studocu

Image Result For Teacher Recruitment Flyer Teacher Recruitment Job Fair Substitute Teaching

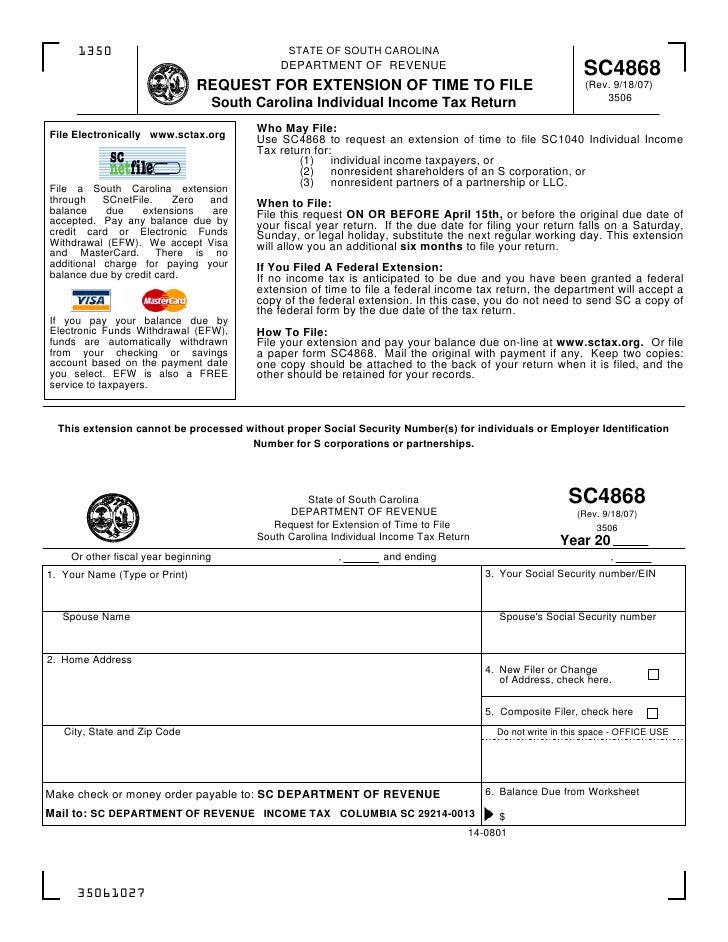

Request For Extension Of Time To File South Carolina Tax Return File

Pin By Christine Underwood On Farm Horse Lessons Waiver Of Liability Form South Jordan Utah

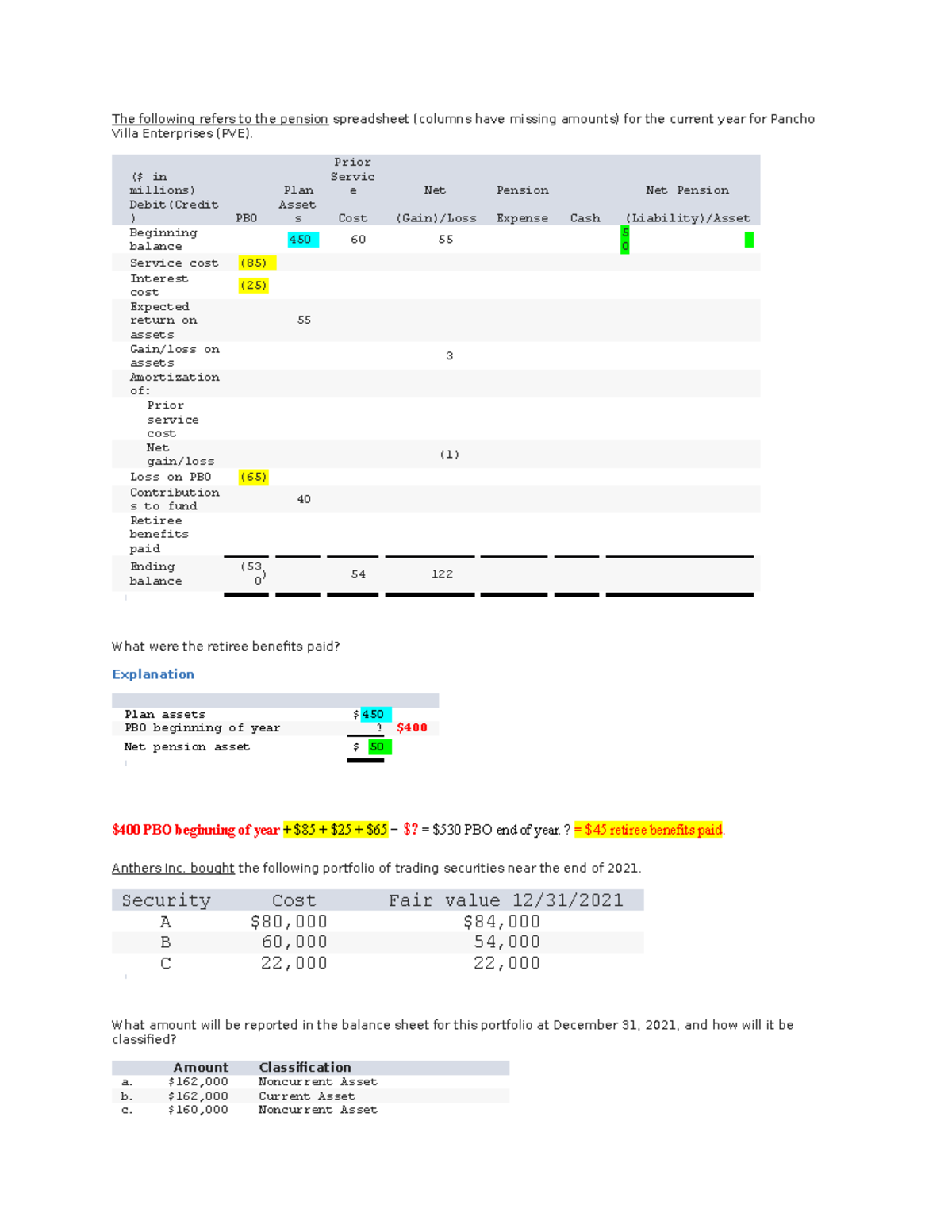

Practice Acc 3100 Pension Studocu

I Only Need Help With The Chegg Com

Form Isp 1003a Download Fillable Pdf Or Fill Online Estimate Request For Canada Pension Plan Retirement Pension And Post Retirement Benefit Canada Templateroller

Overclassification At The State Department Shadowproof 2176 1696px Volunteer Police Clearance Request Letter Let Request Letter Writing Help Guided Writing

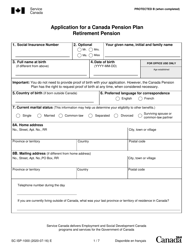

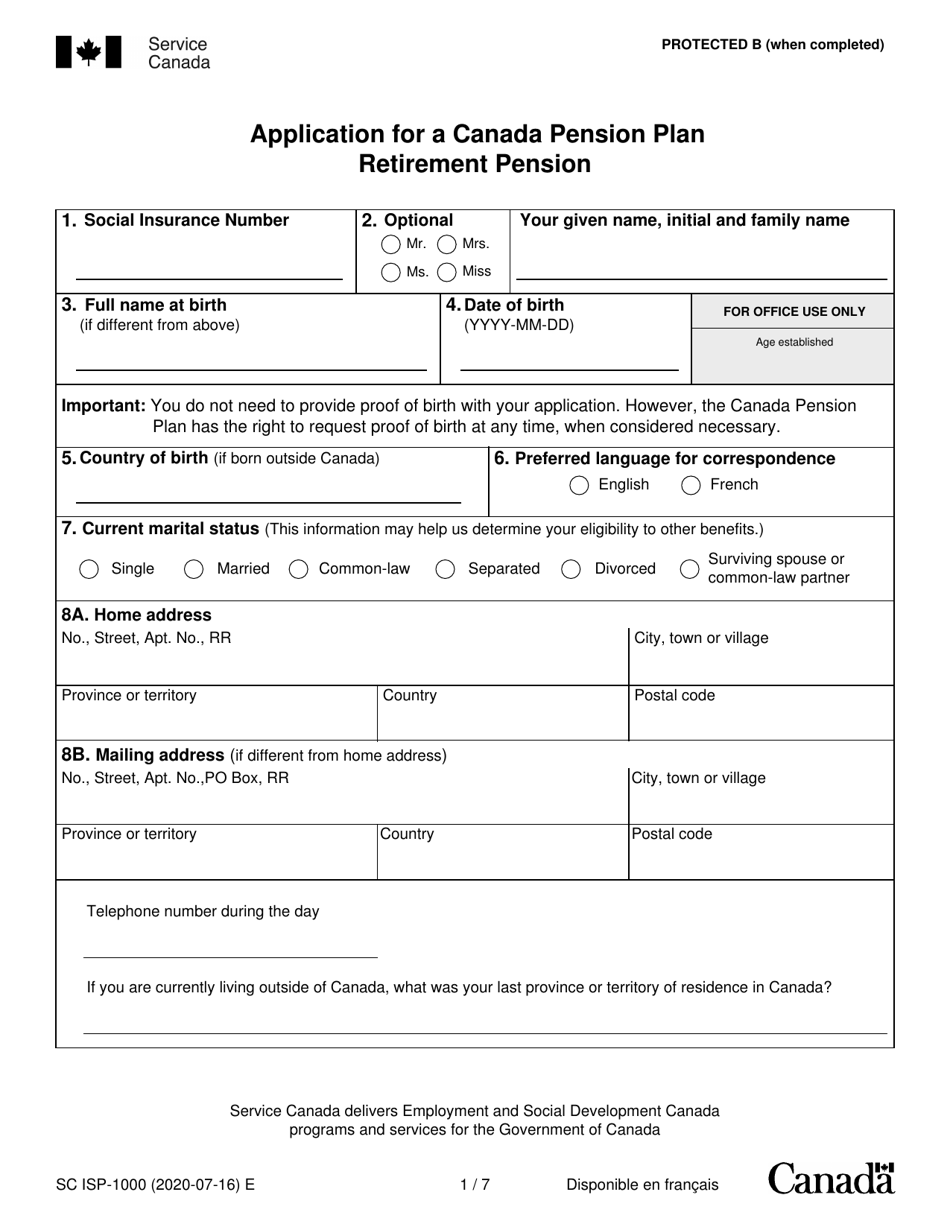

Form Isp 1000 Download Fillable Pdf Or Fill Online Application For A Canada Pension Plan Retirement Pension Canada Templateroller

Chapter 20 Solution Manual Kieso Ifrs By Studocu

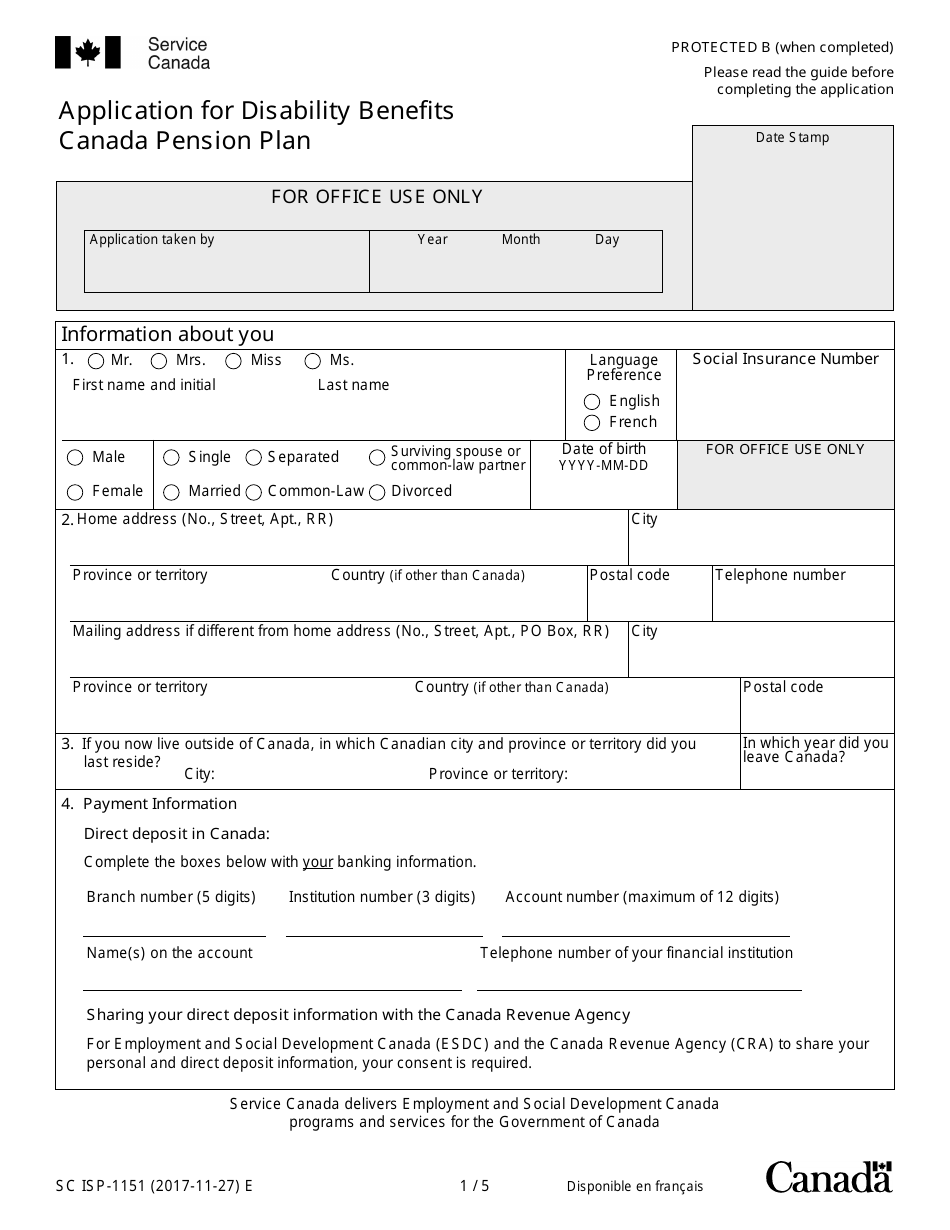

Form Sc Isp 1151 Download Fillable Pdf Or Fill Online Application For Disability Benefits Canada Pension Plan Canada Templateroller

Form Isp 1000 Download Fillable Pdf Or Fill Online Application For A Canada Pension Plan Retirement Pension Canada Templateroller

Oceania Countries With Languages Nationalities Flags 7esl World Country Flags Language Country

Tax Withholding For Pensions And Social Security Sensible Money

Genealogy Of The House Of Hohenems 1889 By Anthony Stokvis 1855 1924 From Manuel D Histoire De Geneal Royal Family Trees Family Tree Victorian Timeline